As nations worldwide emphasize environmentally-conscious initiatives, it’s become increasingly important to take ESG reporting and compliance seriously. Up from 35% in 2010 to 86% in 2021, most of the world’s leading companies now prioritize sustainability transparency by including ESG disclosures in their yearly reports.

At Keter Environmental Services, we help organizations become ESG-compliant by collecting company-wide recycling and waste data. Then, we use that data to assist your company in reporting on your ESG initiatives.

Keep reading to discover how environmental, social, and governance reporting works and how we can help you collect, monitor, and communicate your sustainable recycling and waste accomplishments.

What Is ESG Reporting?

ESG compliance means adhering to the principles of the environmental, social, and governance (ESG) guidelines established by ESG compliance frameworks and regulatory bodies. ESG compliance criteria aim to ensure companies operate responsibly and sustainably in policy and practice. Companies can avoid legal repercussions and regulatory penalties by maintaining and sharing accurate data about the sustainable achievements of their businesses.

.jpg)

Why Is ESG Reporting Important?

ESG reporting is important because it helps companies showcase their commitment to environmental, social, and governance issues and to demonstrate corporate sustainability transparency and accountability. Tracking and reporting ESG data helps organizations improve risk management, enhance their reputation, and attract investments from sustainability-conscious investors. ESG tracking and reporting fosters an environment where organizations can reflect and find actionable ways to improve.

When organizations demonstrate sustainability improvements through successively higher ESG scores, investors view the company as actively mitigating risks. Companies that do not prioritize sustainability transparency may miss out on investment opportunities, which can significantly impact the company’s success.

With 66% of consumers saying they are willing to pay more for sustainable products, we know investors aren’t the only ones paying attention to your ESG initiatives. Taking a stance against unsustainable operating practices will also make a difference to your employees and internal stakeholders.

ESG Reporting Requirements

ESG reporting requirements vary by region and industry, with some sectors having more stringent regulations than others. With the increased awareness of ESG issues, there is a growing demand for standardization and global adoption of uniform ESG reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), among others. These frameworks guide companies in consistently identifying, measuring, and disclosing ESG information. Despite this growing demand, we have yet to reach a global consensus on reporting standards to date.

Without that global consensus, ESG sustainability reports cover a general set of quantitative and qualitative information across environmental, social, and governance aspects that we can discuss in more detail.

Environmental Reports

Environmental reports disclose how companies manage their environmental impact, which includes effects on climate change and natural resources.

Environmental factors considered:

- Waste management

- Energy efficiency

- Climate change

- Carbon emissions

- Biodiversity

- Air

- Water quality

- Deforestation

Recommended reading: 3 Reasons for Environmental Reporting

Social Reports

Social reports disclose how a company impacts its people internally, the company culture, and their effect on the local community.

Social factors considered:

- Diversity and inclusion

- Employee engagement

- Customer satisfaction

- Community relations

- Data protection and privacy

- Abiding by human rights laws and labor standards

- Following labor standards

Governance Reports

Governance focuses on corporate accountability, transparency, and ethical and legal company management.

Governance factors considered:

- Company leadership and board composition

- Executive compensation

- Audit committee structure

- Bribery and corruption

- Lobbying

- Political contributions

- Whistleblower programs

- Internal controls and shareholder rights

What Are ESG Scores?

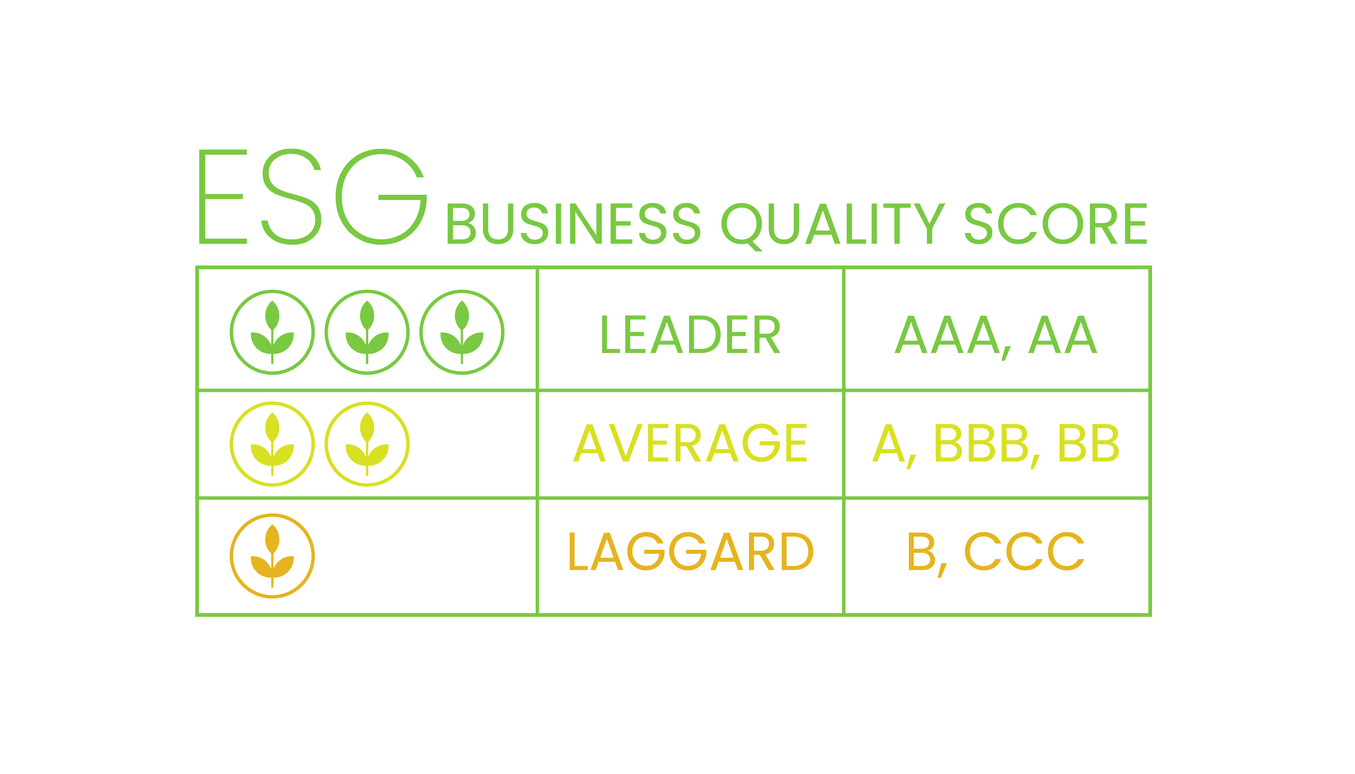

ESG scores are a way to evaluate a company's ESG performance. These scores provide investors and stakeholders with a comprehensive understanding of a company's commitment to sustainable practices, responsible corporate behavior, and risk management.

ESG scores reflect various factors, such as a company's carbon footprint, employee diversity, and corporate governance structure. Companies with higher ESG scores are more likely to manage risks and sustainability aspects effectively, leading to better long-term financial performance and a positive brand reputation.

Who Assigns ESG Scores?

Specialized rating agencies and research firms that analyze companies' Environmental, Social, and Governance (ESG) performance assign ESG scores. These organizations gather data from various sources, such as corporate reports, third-party databases, and news articles, to assess ESG company practices and policies. Some of the leading ESG rating agencies include MSCI, ISS ESG, Sustainalytics, Refinitiv, and FTSE Russell.

Each agency employs different methods and criteria to evaluate companies and assign ESG scores. Since there is no universal standard for ESG scoring, the evaluations and scoring can vary significantly from firm to firm. To understand a company's ESG performance, investors and stakeholders may consider multiple ESG ratings and conduct research.

Benefits of ESG Reporting

ESG reporting offers numerous benefits, the most significant of which is promoting sustainability transparency and accountability from corporations. By reporting on environmental, social, and governance factors, companies can enhance their reputation, attract investments from sustainability-forward investors, and mitigate risks.

ESG reporting supports better decision-making, boosts employee engagement, and helps organizations gain a competitive edge in the market, ultimately supporting your company's long-term growth.

Additional ESG reporting benefits include:

- Risk management: Improved insights into your company’s environmental, social, and governance risks.

- Brand reputation: Enhanced public image and customer loyalty through responsible corporate policies and actions.

- Access to capital: Attracting socially responsible investors and potentially lowering borrowing costs.

- Operational efficiency: Cost savings and improved processes.

- Employee retention: Attraction and retention of top talent by prioritizing social and environmental responsibilities.

- Regulatory compliance: Staying ahead of emerging ESG-related regulations to avoid penalties.

- Stakeholder engagement: Strengthened relationships and trust through transparent communication.

- Competitive advantage: Differentiation from competitors by excelling in ESG performance.

- Long-term value: Integration of sustainability into your entire business strategy, driving value for stakeholders.

Recommended reading: ESG Promotion Checklist

The Future of Environmental Social Governance Reports

As public awareness of ESG issues grows, companies committed to ESG reporting will be better positioned to meet stakeholder expectations, stay ahead of regulatory changes, and drive ongoing business growth. While ESG reporting remains mostly voluntary, global companies must commit to ESG reporting as more “soft laws” will continue to become legally binding.

Other ESG Frameworks

Various ESG frameworks share some similarities, for example:

- GRI, SASB, and CDP were made similar to simplify disclosure and attempt a level of standardization.

- GRESB offers more extensive guidance, with approximately half of the disclosures aligning with SASB.

- UNPRI aligns with GRI, incorporating the 17 Sustainable Development Goals (SDGs) into its framework.

- DJSI is more industry-specific, aligns with the climate-related aspects of CDP, and follows the recommended disclosures from SASB.

ESG Reporting FAQs

What's the Difference Between ESG and CSR?

ESG and CSR are two frameworks for communicating sustainable and responsible business practices. CSR (corporate social responsibility) is a subset that falls under the broad ESG (environmental, social, governance) scope. CSR focuses on a company’s philanthropy, volunteerism, and community engagement initiatives. On the other hand, ESG takes a broader approach to addressing social and environmental challenges. A company can use the CSR framework to demonstrate its commitment to being a socially responsible corporate citizen. It may include it as a component in its ESG reporting methods.

What's the Difference Between ESG and Sustainability?

ESG (Environmental, Social, and Governance) and sustainability are related (or interconnected) concepts with a common goal of promoting responsible and environmentally friendly business practices. ESG refers to criteria used to evaluate a company's environmental protection, social responsibility, and corporate governance performance. Investors, rating agencies, and other stakeholders use ESG factors to assess a company's commitment to addressing sustainability risks and opportunities. ESG is a concept nested under the broader sustainability umbrella.

Sustainability encompasses the ability of a company or system to endure and thrive over time by balancing economic, social, and environmental considerations. In contrast, ESG factors provide a framework for measuring and reporting on specific aspects of a company's sustainability performance. The concept of sustainability encompasses a wider range of issues and goals that drive long-term resilience and success.

How Do I Start ESG Reporting for My Company?

Use the steps below as a guide to start your ESG reporting journey. Keter Environmental Services can assist you if you need help implementing these steps.

- Develop an ESG strategy: Identify the environmental, social, and governance aspects of most importance to your company, considering stakeholder expectations and industry and ESG reporting standards. Here at Keter Environmental Services, we work with you to help you define your goals and how to fix them.

- Assemble a team: Decide who will oversee the ESG data collection, analysis, and ESG data reporting process.

- Choose a reporting framework: Select an ESG reporting framework, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), to guide the creation of your disclosures.

- Engage with stakeholders: Consult with various stakeholders, including investors, employees, customers, and suppliers, to understand their expectations and desires regarding your ESG priorities.

- Collect and analyze data: Gather data on relevant ESG indicators. At Keter, our proprietary software helps you efficiently collect and analyze your waste and recycling data across your enterprise.

- Prepare the ESG report: Use your data and analysis to create a detailed ESG report demonstrating your company's commitment to sustainability and responsible business practices. Here at Keter, we help you turn your waste and recycling data into a comprehensive report with actionable insights on ways you can improve your ESG performance. If you’re looking for ESG reporting software, we can help.

- Communicate and engage: Publish the ESG report and share it with stakeholders. Engage with your stakeholders to gather feedback and discuss your progress across your ESG initiatives.

- Monitor progress and continuously improve: Periodically review your company's ESG performance, set new goals, and update your reporting.

What is an ESG Disclosure?

An ESG disclosure, or ESG report, is a company’s statement that outlines its environmental, social, and governance (ESG) performance and provides insight into how it addresses sustainability issues and manages related risks.

Achieve Data-First Recycling and Waste Services With Keter

Here at Keter, our mission is to help corporations reduce waste, improve recycling, and communicate their ESG initiatives. Keter recycling and waste solutions include end-to-end data-driven methods that help you reach your ESG and sustainability goals. Whether you need waste data collection or want help from start to finish, we can help you reach your ESG goals and keep costs consistent for your company.

Read next: Are your waste solutions helpful?